Are you searching for top kiddies savings accounts in Nigeria? If you are, you are in the right place.

Really, opening a savings account for a child has become an indispensable part of parenting and child upbringing.

It’s not enough for you to just provide the basics – clothing, food and shelter – for your children.

You also have to give them a little nudge on their way to financial independence.

Ultimately, this also safeguards their future against whatever emergency needs that might pop up in the nearest future.

Recently, we have seen people gift newborns a Kiddies’ Savings accounts. Cool, right? This means “it’s never too early to start planning for your kid’s future” by opening Kiddies Savings Accounts.

What To Consider First

However, right before you dive in to see our list of the Top Kiddies savings accounts in Nigeria, you might want to steal a quick glance at the checklist to consider before choosing a savings account for your child.

- Accessibility: Choose a bank that allows for express access to your child’s money any time you need it. The bank should also let you close the account anytime you want.

- Fixed savings account: This attracts more interest rates as you can’t just withdraw the money for minor issues. The money has to be kept until a set time, which is the whole point of the account in the first place.

- Incentives: Some banks host end of the year parties, give gifts to the children periodically, provide scholarship opportunities and even grant loans for school fees.

- Regulations: The account should have no minimum balance requirement. Also, It should not have monthly maintenance fees or any other charges you feel are unnecessary.

- Online banking: They should have an online app so you can manage your child’s account from the comfort of your home/office.

- High-interest rate: Choose one with a high-interest rate. This is very important.

Now that you have been armed with the right information, let’s get into the main course.

Shall we?

1. Smart Kids Save:

This is the Guaranty Trust Bank savings account for children of 0 to 17 years old.

The account is designed to create financial awareness in children and promote a savings culture from an early age.

It comes with a fancy Naira MasterCard for teenagers with which you can allocate their pocket money whilst still retaining control of the main account.

Smart Kids Save teen card is issued when the smart kid attains age 13 and older.

Features of the Smart Kids Save account include a minimum opening balance of N1,000.00. Provision of gift items when milestone points are achieved.

Other features are competitive tiered interest rates, the more you save the more you earn for an amount below one million Naira – 0.5% above prevailing savings rate one million Naira to below five million Naira – 0.75% above prevailing savings rate N5,000,000.00 and above – 1% above prevailing savings rate.

This permits lodgments of Cheques, Drafts and Complimentary invite to their Fun events, and then converted into a regular savings account, with the young saver as an authorized signatory when he/she is 18 years of age.

Access to smart kids website (http://www.gtbank.com/sks) where the smart kid has access to cool games, educational support for homework/ study and other fun activities.

2. Early Savers Account

This is an Access Bank children bank account for children below the age of 16 years.

Also, it covers even those unborn.

Furthermore, the account can be opened in trust for a child by the parent/guardian who will be the primary account holder.

The parent/guardian has the responsibility of managing this account until the child attains adulthood.

Additionally, at the time the child solely operates his or her accounts or possibly move to other age-appropriate accounts.

The Early Savers Account features an opening balance of N1,000 Minimum.

Also, it comes with clauses – withdrawal per quarter, and no card is being issued on this account.

Beneficially, the Early Savers Kiddies Savings Account allows Access to school fees advance.

Additionally, the account comes with a free membership to the Early Savers Club. Added to it is a free quarterly Early Savers newsletters and ease of saving through standing order instruction.

Others are an invitation to exclusive Access Early Savers events, plus the account is online and can be easily monitored from anywhere.

Requirements for Early Savers Kiddies Account.

Passport photograph of the child. Passport photograph of the parent or guardian. Recent Utility bill. Birth certificate of the child. The valid ID card of the parent-PVC, NID, DL, or INT’L Passport.

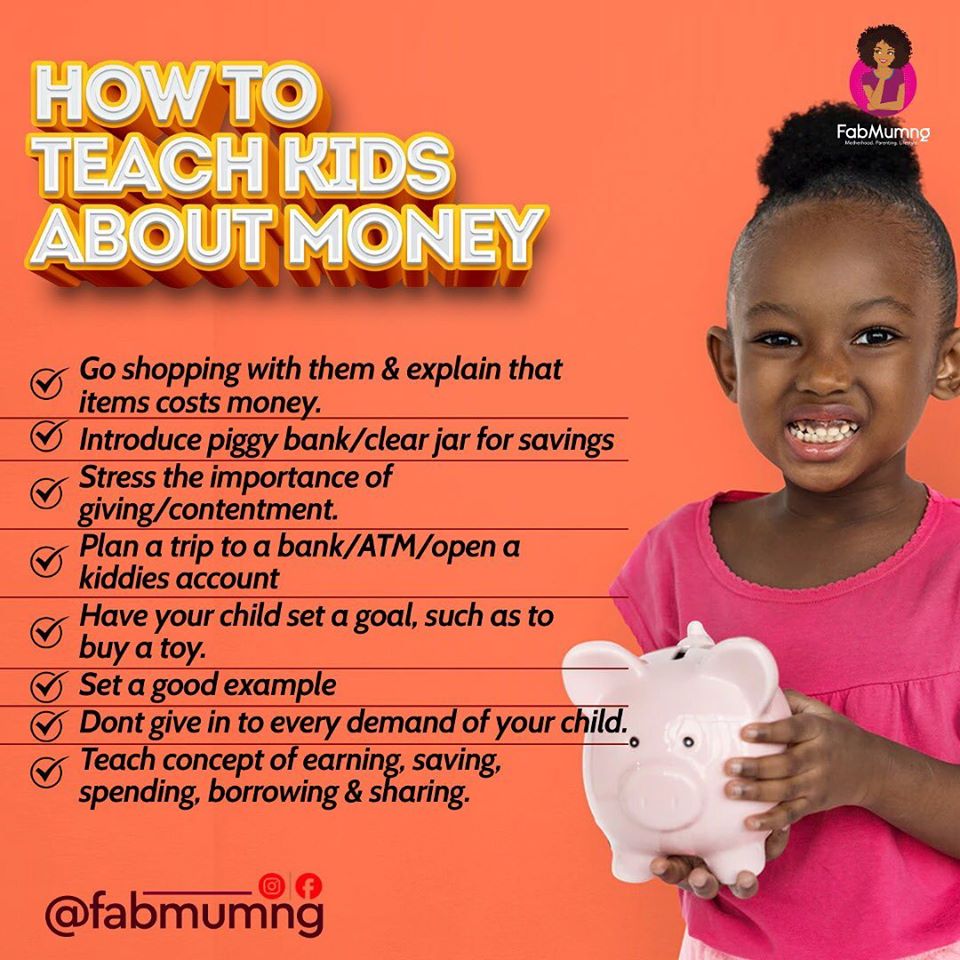

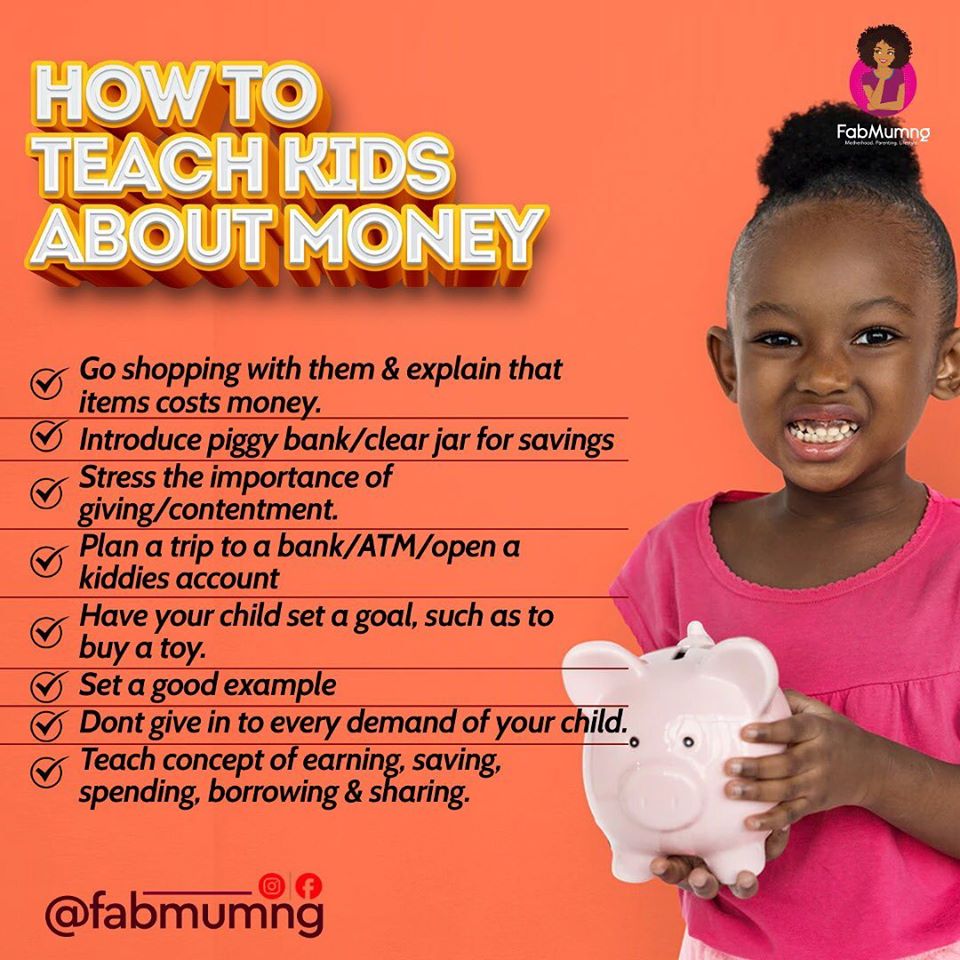

Here’s a post on how to teach your child about money which you might like

3. Kids Account

FCMB calls theirs the Kids Account.

This is a savings account suitable for kids between ages 0-15.

Some features and benefits of FCMB Kids Account are an opening balance of N5,000, a non-clearing cheque-type withdrawal booklet used for withdrawal by the account holder alone.

A minimum operating balance of 2,000 Naira and Free email transaction notifications.

Others are Free ATM money box, an opportunity to win N10,000 monthly for 10 years in Kids account pocket money promotion and Free birthday.

Requirements for FCMB Kids Account.

A completed account opening form.

One passport photograph of parent/guardian

One passport photograph of the child

Birth certificate of the child and a recent Utility Bill.

4. Kids First:

This is a First Bank kiddies savings account.

This account is designed for children between the ages of 0-12 and opened with a minimum operating balance of N1000.

The account is opened in the child’s name and operated by the parent or guardian.

Also, it features a trendy gift item for the child when the account is opened with a minimum of N10,000 standing order on payment of tuition/other fees.

With this account, your child also gets to enjoy fun activities such as cool treasure hunts, cinema events and much more all year round, courtesy of FirstBank.

The First Bank package also presents an automatic transition to MeFirst account when the child attains the age of 13 Ease and convenience of online banking Cheque/Dividend warrant of up to N2 million can be lodged into the account.

Requirements to open the KidsFirst Savings include a Passport photograph of the kid and parent/guardian, Birth certificate of the child, Valid ID card of the parent/guardian, and a Utility bill not older than three months.

5. Fidelity SweetA Account

This is a Fidelity bank children bank account, designed for kids between ages 0 -17.

The Fidelity SweetA Account has an operating balance of N1,000 Monthly, interest payment Benefits, Quarterly royalty reward scheme in place and Issuance of debit cards to account holders of 15 to 17 years of age.

Others are an annual SweetA party for all account holders, Birthday gifts, unlimited number of withdrawals, You can also lodge in Cheques and Dividend warrants, Draft issuance inclusive.

Requirements are 1 passport photograph for both child and parents, Child’s birth certificate, Valid ID card for the parents.

6. Royal Kiddies Account:

This is the Wema Bank account designed for kids between 0-12 years of age.

Features of Royal Kiddies Account include a Minimum opening balance of N2k, a minimum operating balance of N5k. Others are a Free branded welcome pack on account opening, a 1% interest rate above standard savings account.

Withdrawal from this account is limited to once per month otherwise interest is forfeited for the month.

Also, the account type has as part of the package lodgement of dividend warrants and cheques in the child’s name are allowed.

Although one referee needed, No charge for bank draft purchased for payment of school fees for the account holder, allows standing order for regular savings (from parent’s/guardian’s accounts) and for payment of school fees.

The child is eligible for the Wema annual Educational award, and although no debit card is issued on this account, a virtual card- Royal kiddies E-Purse is available on request; this card is however not linked to the account.

7. Zenith Children’s Account:

The Zenith bank children’s account is for kids between ages 0-12, while the Zenith bank children’s account for teens is from 13-17 years of age.

Also, the Zenith Bank Children’s account has its own features.

First, the account is specifically for children between the ages of 0-12 years include.

It has a zero account opening balance, interest rate of 4.2%, Standing order credit option Cheque and draft dividend lodgement.

Others features are an automatic invitation to the annual Zenith Children’s parade. Participation in children’s day raffle draw.

8. U-Care Savings Account:

This is the UBA version of a kiddies savings account.

It’s an education-based saving account. It is also opened in the name of the beneficiary and designed to support education through Primary and Secondary school years.

The benefit of U-Care Savings Account range from interest rate given at normal savings rate, It comes with a credit facility availability to cover the shortfall on School fees (for salary account holders only).

Another feature is a freestanding order fee for transfer into account internally, SMS alert on Birthdays, Free internal network transactions on account, School fees payment online. However, this is if a school is signed up.

9. Unity Kids Account

This Unity Bank kiddie’s savings initiative encourages savings from childhood.

Also, it offers an opportunity to win a scholarship, a free birthday card and a welcome pack for customers who open their accounts with N10,000 and above.

10. Polaris Rainbow Account

This Polaris Bank account is designed for children between 0-17 years of age.

Like others, this account also has its requirements and they are; child’s parents’ passport photograph, Utility bill, Parents BVN (Bank Verification Number).

This account has an interest rate of 1% above the standard savings rate.

NB: The Kiddies Savings Accounts on this list were placed in no particular order.

Review each one of them closely and go with whichever one appeals to you.

Take your final decision, bearing in mind the: monthly withdrawal limits, opening balance, interest rate, if ATM card is issued on the account, Dividend warrant lodgement, etc.

These parameters will enable you to make a sound decision regarding the best kiddies savings account to open for your kid(s).